Improve your financial products based on customer feedback data

Collect customer feedback data daily about your financial products, published on major digital platforms. Compare this data with your competitors' feedback and receive recommendations on practical steps to increase customer satisfaction and acquire dissatisfied customers from your competitors.

Yellow Tokens is the result of over 20 years of experience helping large companies develop customer-focused solutions.

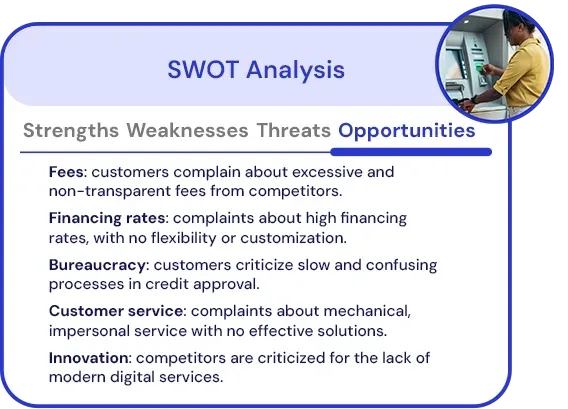

Banks and Financial Institutions

Monitor customer feedback on your fees, financing rates, bureaucracy in credit acquisition, and the quality of service provided. Compare this data with your competitors' and identify opportunities for differentiation.

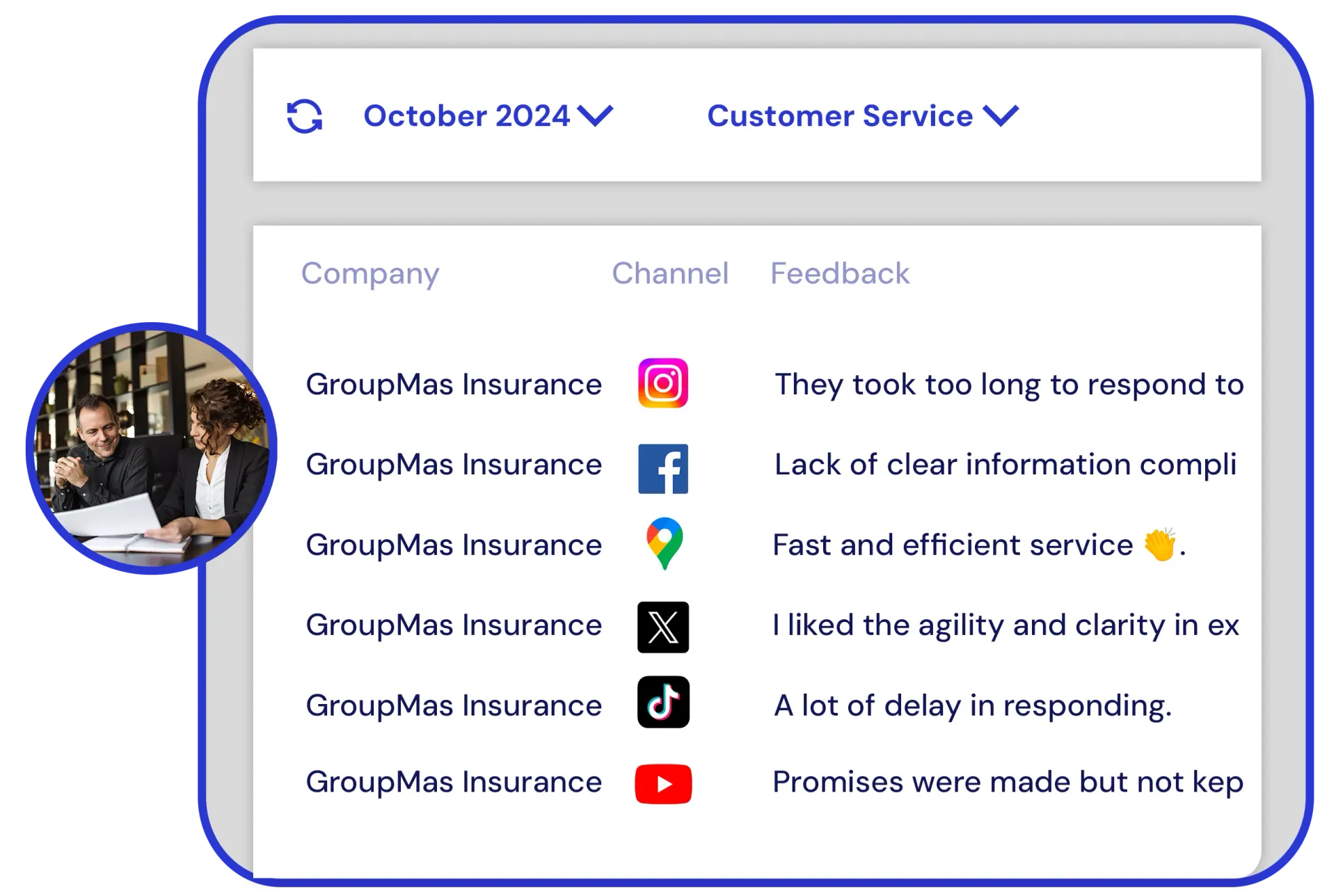

Insurance Companies

Insurance companies use Yellow Tokens to collect daily customer praise and criticism about each of their insurance products. Feedback posted on major digital platforms is collected and presented in one place, highlighting the most discussed topics.

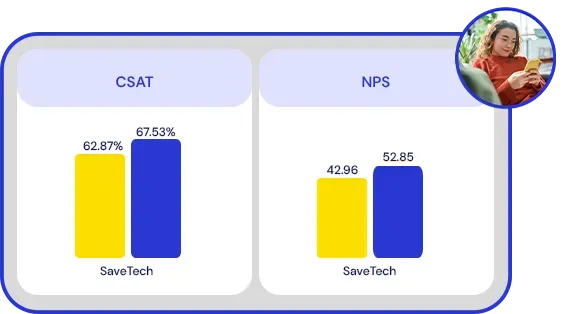

Fintechs

Create new products or adjust the features of your existing digital products based on daily customer feedback data. Access metrics such as CSAT and NPS for your company and track which features your customers praise the most in your products.

Explore solutions for your industry.

Yellow Tokens helps companies across different sectors of the Financial Industry gain a unified view of customer feedback.

Commercial Banks

Monitor customer opinions on banking services, fees, customer service, and digital products, adjusting your offerings to ensure satisfaction and retain account holders.

Financial Institutions

Track feedback on credit conditions, service speed, and ease of access to services, optimizing your offerings and earning customers' trust.

Insurance Companies

Collect feedback on coverage, claims processes, and customer service, improving the experience and increasing trust and retention among policyholders.

Fintechs

Capture feedback on the usability, innovation, and efficiency of your digital financial products, driving the development of solutions that delight and retain customers.

Choose a plan that suits you

Define the number of companies, establishments, and products you want to monitor, as well as the number of team members.

You can group companies, establishments, and products into different customized projects.

Companies are monitored

on the following channels:

Establishments are monitored

on the following channels:

Products are monitored

on the following channels:

Each company, establishment, or product entitles you to a certain number of feedbacks to be monitored per month.

If you need to monitor more feedbacks, you can increase your credits at any time.

Ready to place the customer at the center of your business decisions?